How to Set Up Payroll for Just One Employee Fast

It’s finally time to run payroll—for yourself! ADP offers payroll software for one employee to help you get it right from the start.

Get 3 months FREE payroll* * See terms & conditions

Already using ADP? Login or Get support

Affordable payroll for one employee (or more)

ADP has payroll solutions priced for businesses of any size, even those with just one employee. We make it easy to manage the payroll cost for one employee without paying for extra services you don’t need.

As your business grows and you hire more people, you can easily add more features at any time. From day one, we’ll help you choose a service that fits both your goals and your budget.

Benefits of ADP’s payroll services for one employee

The ideal time to invest in automated payroll software is when you’ve hired your first employee. Start with a solution

that frees up your time now and over the long run.

Payroll that helps save time and money

If you’re like many small business owners, you’d rather focus on your product or service, not spend hours doing payroll for one employee. ADP’s payroll software automates those calculations, deductions and payments so you can focus on growing your business. Our small business payroll can also help you avoid penalties for filing payroll taxes late or incorrectly.

Access to compliance tools and tips

With just one employee, you might think you can manage payroll on your own, but complexities go beyond headcount. Regulations are constantly changing, and noncompliance can be costly. Many business owner’s ask, “do I need payroll software for one employee?”. That’s why ADP’s payroll software is designed to help you manage compliance requirements with confidence.

Trusted support when you need it

Your employee relies on you for prompt wage payments, and you can count on us to help you deliver on that promise. Our knowledgeable payroll professionals can answer your questions and guide you through running payroll for one employee with ease. And if something does go wrong, we’ll work to correct it and keep your payroll running smoothly.

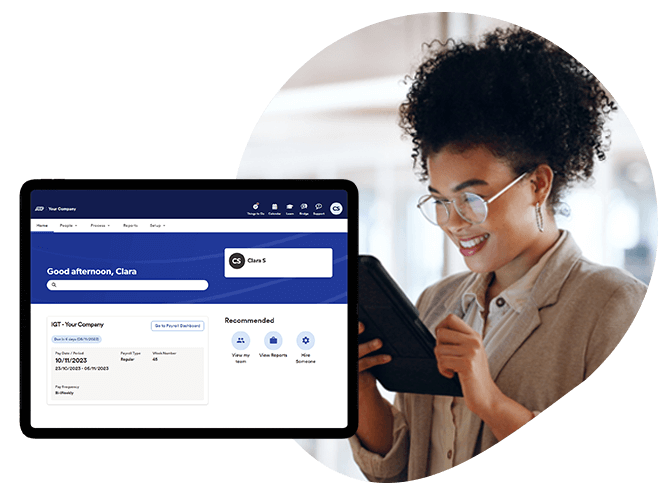

Online payroll that is always accessible

ADP's online payroll system redefines convenience, offering unparalleled access anytime and anywhere through just a few clicks on your phone or tablet. If you’ve ever asked yourself, “How do I do payroll for one employee?” This user-friendly platform provides a simple answer — making it easy to view your employee’s payroll details and manage payroll without the constraints of time or location.

MEET OUR CLIENTS

The fact that ADP Workforce Now is a bilingual solution is allowing us to stay compliant in the province of Quebec.

VP of People, food delivery, Quebec

MEET OUR CLIENTS

Working together to get to this final product was a very positive experience. I couldn’t have done it on my own. If I outsourced it and involved a lawyer or another consultant, I know it would’ve been much more expensive and probably taken a lot longer.

Darla Selles Controller, Smart Start Canada

MEET OUR CLIENTS

I don’t believe a small business using ADP would have difficulties with a payroll audit. ADP knows the rules well and helps organizations like ours follow them.

Joyce Fergusson Controller, Kaiser Lachance Communications Inc.

MEET OUR CLIENTS

You just log on and all the information is in one place. You use two screens and it will even check all the information for you, and let you know if there are any errors before you submit.

Tessa Bernier Owner, Moksha Yoga Kingston

MEET OUR CLIENTS

ADP has been able to help us take our attention away from the back-office work and focus on our core product. They really understand the values of small businesses, and they understand how to provide us with the service and the attention that we need.

Colin Carter Founder & CEO, BitCine Technologies

Join the nearly 40,000 Canadian small business clients that count on ADP for faster, smarter, easier payroll

Start Quote5 steps to set up payroll for your first employee

Not sure how to run a payroll for one employee? Here’s a quick overview of the steps involved:

- Open a payroll account with the CRA: Register a payroll account with the CRA using your existing business number or obtain one during the setup process.

- Collect employee details: Gather your employee’s Social Insurance Number (SIN) and have them complete the Federal and Provincial TD1 forms for tax calculations.

- Determine the Province of Employment

- Calculate deduction: Determine and set aside the required federal and provincial taxes, Canada Pension Plan (CPP) contributions, and Employment Insurance (EI)premiums from their gross pay.

- Remit deductions: Pay the calculated source deductions to the CRA, either through their website, at a financial institution or via online banking by the 15th of each month.

- Prepare year-end T4s: Complete and submit T4 slips for each employee, summarizing their earnings and deductions, and file the corresponding T4 summary report with the CRA by the end of February.

Payroll designed for self-employed small business owners

Running a business can be stressful. That’s why we built ADP Workforce Now On the Go® — a smarter mobile payroll solution designed specifically for small business owners. Stay on top of payroll for yourself and all the tasks on your list. Run your payroll, access payroll reports and view schedules anytime, anywhere.

Mobile payroll made fast, easy, and affordable

The payroll solution for small business owners is here. ADP Workforce Now On the Go makes paying yourself, filing taxes, handling business operations, and so much more, surprisingly easy. Get started with simplified small business payroll in seconds.

One minute overview

ADP has reimagined what’s possible, to make running payroll and HR better than ever before.

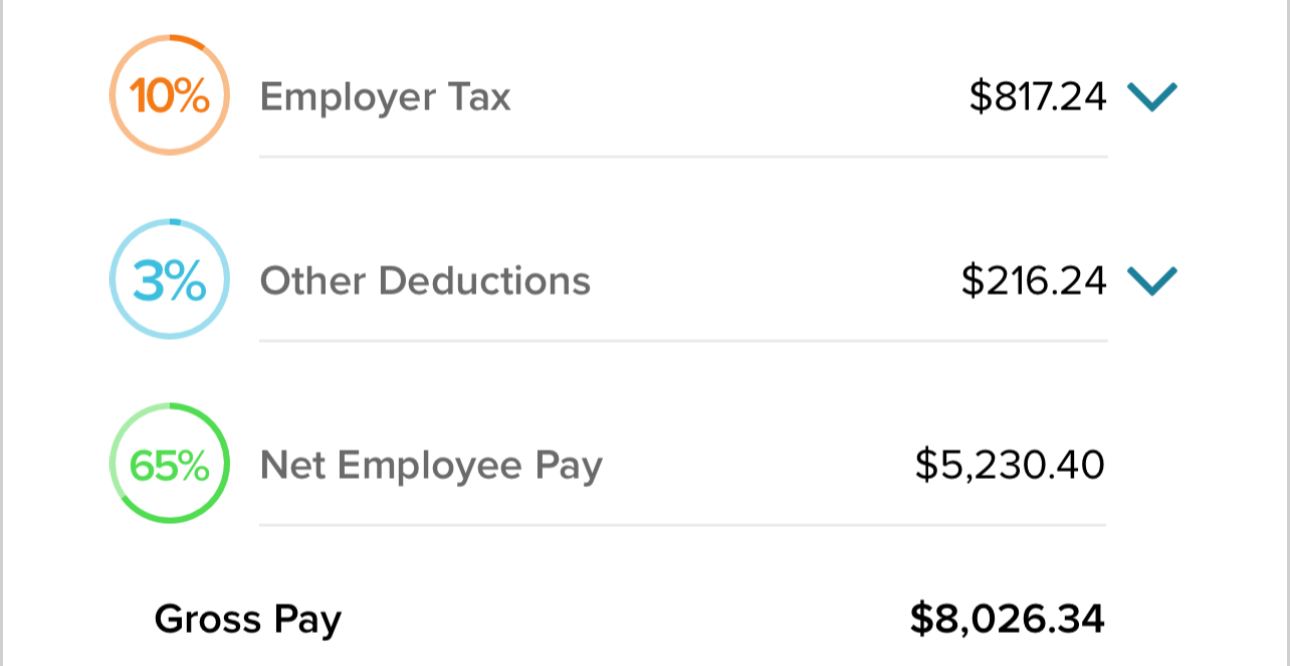

Payroll calculator

Curious how much pay employees take home after taxes? Run the numbers on our free pay cheque calculator.

Expert insights for small business owners

tool

Payroll Checklist for Small Business

insight

Payroll taxes: What they are and how they work

insight

Software for small businesses

Top FAQs about payroll for one employee

What is the easiest payroll software to use?

There are dozens of payroll companies out there, all offering different levels of usability. Some are more “DIY,” while others may send a company representative to your business to train you on the product. The easiest solution for you will depend on your needs.

How do I do payroll manually?

Processing payroll manually requires painstaking data entry and recordkeeping and the ability to meet deadlines. If you choose to pay your one employee this way, you’ll need to:

- Agree upon a salary or hourly wage

- Use a time clock or other means to track hours worked

- Calculate gross wages

- Deduct any other pre-tax benefits you offer

- Withhold any taxes that apply

- Calculate employer contributions to CPP, employment insurance

- Deduct garnishments and post-tax benefits, if applicable

- Pay your employee by cheque or direct deposit

Keep in mind that even with just one employee, there’s a chance you can make a mistake when processing payroll manually, which may result in fines from government agencies.

How much does ADP charge for one employee payroll?

Cost is an important consideration for any business, but it’s also important to think about the overall value you’ll receive from a payroll service provider. ADP offers various levels of customer support, integrations, and related products, which affect price totals. We’ll work with you to determine the package that best suits your business needs.

How do I set up payroll for one employee?

To pay your one employee, whether you’re doing it yourself or working with a payroll service provider, you will need:

- Social insurance number (SIN)

- Employee’s tax withholding documents

- Defined pay periods

How to set up payroll for one employee in Canada?

Here are 5 steps outlining how you can set up payroll for one employee in Canada:

- Start a payroll account through the CRA. If you have a business number, simply add a payroll account to it and get a 15-character number from CRA for tax tracking. Without a business number? One will be assigned during the payroll account setup.

- Collect your employee's personal details which can be important for payroll processing, such as their Social Insurance Number. Then have them fill out Federal and Provincial TD1 forms, which help in determining the income tax deductions. Quebec employees need to complete an additional Source Deductions Return form.

- Set aside employee and employer contributions for taxes, Canada Pension Plan (CPP), and Employment Insurance as per the legal requirements. You can use the CRA’s online calculator for precise calculations of these deductions, factoring in various tax rates across provinces and territories.

- Timely remit the calculated deductions to the CRA. You may do this through its website, a financial institution, or online banking. Regular remittances are due monthly by the 15th and it may help to avoid delays to prevent penalties. With a consistent track record, you might qualify for quarterly instead of monthly remittances.

- Wrap up the tax year by issuing T4 slips to employees, listing earnings, benefits, and deducted amounts for CPP, EI, and income taxes. Also, submit a T4 summary to the CRA by the end of February. Quebec employers additionally provide Relevé 1 slips and a summary of salaries and deductions.

How much does an employer pay for employee taxes in Canada?

Canadian employers are responsible for matching their employees' contributions to the Canada Pension Plan (CPP) or the Quebec Pension Plan (QPP), depending on the province. For 2025, the CPP contribution rate is set at 5.95%, with a maximum contribution limit of CAD$4,034.10. In Quebec, the contribution rate remains higher at 6.40%, capped at CAD$4,339.20. Additionally, Canada has formed social security agreements with various nations, which help individuals who have worked in both Canada and other countries manage their pension contributions.

Employers are also required to contribute to Employment Insurance (EI), which provides financial assistance to individuals during job loss or certain leaves, such as maternity or illness. The EI contribution rate is 1.64% (non-Quebec) with an annual cap of CAD$1,508.97, while Quebec’s rate is 1.647%, capped at CAD$1,204.94. Furthermore, several provinces impose an Employer Health Tax (EHT), calculated based on total employee salaries. This tax varies significantly across provinces: for instance, Ontario's rates range from 0.98% to 1.95%, and British Columbia applies a rate of 1.95% to 2.92%, with specific exemptions based on payroll size. Each province also has its own unique thresholds, and exemption limits that employers must navigate.

How do I pay myself from my corporation?

If you own an incorporated small business in Canada, you can pay yourself through salary, dividends or a mix of both. A salary is considered employment income, so your corporation must run payroll, withhold taxes and CPP contributions, remit them to the CRA and issue you a T4 at year-end. Dividends are paid from after-tax profits, reported on a T5 and may offer tax advantages, but they don’t create RRSP room or require CPP contributions. Many business owners choose a combination for steady income and tax efficiency.

If you take a salary, you’ll need to register for a CRA payroll account, decide on a pay schedule, calculate deductions, remit them on time and prepare year-end slips. While this can be done manually, it’s easy to make errors, especially when navigating federal, provincial and territorial rules. Dividends are simple to administer but may not provide the same personal financial benefits as a salary.

The right payroll software for small businesses in Canada can simplify the process by automatically calculating deductions, remitting payments to the CRA and creating T4/T5 slips. This ensures accuracy, compliance and less administrative work so you can confidently pay yourself from your paycheck and focus on growing your business.

Get a Free Quote

It's time to take ownership to the next level. Fill out the form below to get on board with ADP's payroll for one.

Your privacy is assured.