Small business payroll,

made better

Now, pay your employees with confidence and ease using ADP’s payroll services for small business. Direct deposits, automated payroll taxes, paystubs, T4s - we do it all, so you can focus on what you love doing – growing your business.

Get payroll processing FREE for 3 months*

*See terms & conditionsAlready using ADP? Login or Get support

Pay your employees with ease and confidence

ADP’s payroll services for small businesses helps you simplify your payday, regulate your taxation, and make year-end filing a breeze. With access to expert service and support in English and French, our intuitive platform makes paying your people easier (and more enjoyable) than ever before.

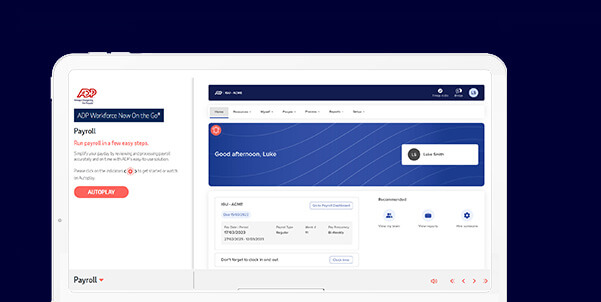

90 seconds video

ADP has reimagined payroll software for small business to make payroll and HR management easier than ever.

Interactive demo

Try our self-led demo to see how easy a payroll software for small business can be.

Payroll programs designed for small business

Running payroll can be simple. With ADP’s small business payroll program, you’ll have the tools you need to pay your employees on time and manage taxes accurately.

Looking for a payroll company for your small business? ADP can help:

- Process payroll in minutes

- Provide direct deposit and digital paystubs

- Automate tax calculations and year-end forms

- Acess payroll support when you need it

Our easy-to-use payroll programs for small business are built to help you save time, reduce manual work and stay focused on your business goals.

Find your perfect small business payroll solution

You've got options — choose the ADP Workforce Now On the Go® package that best fits your business. Whether you’re comparing different payroll companies or searching for a trusted small business payroll program, ADP has flexible solutions built for Canadian businesses.

Enhanced+ Bundle

Enhanced package with recruiting, employee handbook, and more HR features.

Hear how ADP’s Small Business Payroll helps businesses like yours

MEET OUR CLIENTS

There’s always somebody from ADP who is quick to answer and help; I’m grateful to be able to get my questions answered right away.

Lisa Fiorotto-Bickert Owner and CEO, Deuce Tattoos

MEET OUR CLIENTS

I can process payroll in under three minutes. Before, there were all these steps, and I would question if the numbers were correct, but not anymore.

Jackson Uppal Owner, Rice Burger

MEET OUR CLIENTS

I don’t believe a small business using ADP would have difficulties with a payroll audit. ADP knows the rules well and helps organizations like ours follow them.

Joyce Fergusson Controller, Kaiser Lachance Communications Inc.

MEET OUR CLIENTS

We’re able to work with our ADP representative to quickly prepare our payroll and make sure our employees are paid on time and within government regulations. Using ADP Workforce Now Comprehensive Services has cut my assistant controller’s time in half. With that extra time, she’s able to reach out to our members and contact them if needed. It really gives her extra time during the day.

Kyle Holowaychuk CPA, Financial Controller, Royal Mayfair Golf Club

MEET OUR CLIENTS

Like any small organization, payroll is just one of my many job duties that I am responsible for. It is important that I complete payroll as accurately and quickly as possible, so that I can concentrate on other priorities.

Dianne Ashton Accounting Clerk, Town of Berwick

Join over 40,000 Canadian businesses that count on ADP Canada for faster, smarter, easier small business payroll.

Start QuoteFast, smart and easy small business payroll for Canadian businesses.

Full-Service Payroll & Tax Filing

Payroll done faster, tax filing done for you

It’s not easy running a small business. We’re here with the payroll and tax solutions and support you need, when and how you need them:

- Process payroll in minutes, at your desk or on the move

- Payroll taxes calculated, deducted, and paid automatically for you

- Quarterly and annual reporting done for you

- Forms (T4s, Relevés) created and sent automatically to your employees

- Integrate time-tracking with payroll

CONFIDENCE & COMPLIANCE

Help avoid costly mistakes before they happen

ADP’s reliable payroll software for small business helps you manage compliance with payroll and tax requirements, wage and hour laws, and much more. We keep you updated on changing tax laws and regulations across all provinces of Canada, while also helping you streamline and automate processes.

With built-in employee self-service, your team can easily access pay information, update details and manage their own data, saving you time and reducing errors. Plus, our world-class global security organization helps ensure that your and your employees’ data is safe and secure.

EXPERT SERVICE & SUPPORT

Always have peace of mind with support from experts

We know it's not easy running a small business, so we're here to help you get the answers you need, when and how you need them. Call or chat with us to get help from our payroll experts.

Why companies chose ADPs payroll service in Canada

Over 40,000 small businesses in Canada trust ADP® to deliver a better payroll experience. As one of the established payroll providers for small business, our expertise and easy-to-use platforms simplify small business payroll and HR, so you can stay focused on the work that matters most.

ADP is built on the promise of helping you get payroll right, so you don’t have to worry about it.

Small business payroll FAQs

How much does small business payroll cost?

The cost of small business payroll depends on several factors, including payroll frequency, total number of employees and the specific services that are needed. Most commonly, there is a per-payroll processing fee and an annual base fee. The important thing to remember is that a payroll service may actually save you money when compared to the cost of tax penalties. ADP will work with you to determine the right payroll setup for your business, whether you have just one employee or several.

Can a small business do their own payroll?

Do-it-yourself payroll is a popular choice for some new businesses, but like any other DIY project, it may only save you money if you have the skills and resources to do it correctly. You could be quickly overwhelmed by the amount of time it takes to run payroll on your own and the costly penalties that can possibly ensue if you make mistakes. For this reason, many small businesses turn to a payroll service provider for assistance.

How do small businesses run payroll?

Whether you choose to tackle the job on your own or work with a professional, running small business payroll, in its most basic form, consists of these steps:

- Track and record employee hours worked

- Calculate wages and withholding amounts (taxes, benefits, etc.)

- Distribute wages to employees

- Deposit the withheld taxes with appropriate government agencies

- File employer tax returns at the applicable deadlines

- Send employees T4/Releve and other required tax forms

- Issue Record of Employment (ROE)

-

Throughout each stage of this process, you’ll need to comply with constantly changing regulations – a task that can be difficult without the expertise and assistance of a payroll provider like ADP.

What does payroll software for small business include?

Small business payroll software might have the following features, depending on the payroll provider:

- Capability to manage payroll from any location and device

- Automatic calculation, payment, and filing of taxes on your behalf with proper authorization

- Options for employee self-service and preferred payment methods

- Smart technology designed to identify possible errors

- Built-in compliance with payroll regulations

What are the benefits of using small business payroll software?

One of the main reasons small businesses opt for payroll software is to save time. This software also ensures that employees receive their payments promptly and accurately through their chosen payment method. Consequently, it allows you to dedicate more effort toward enhancing your products or services, expanding your customer base, and pursuing other revenue-generating initiatives.

Does small business payroll software save your business money?

Tax penalties and fines due to payroll mistakes can be costly. Using payroll software can help reduce or prevent these errors, potentially saving you money. Additionally, this software automates the payroll process, which can lower the labour costs involved in managing payroll.

RESOURCES FOR YOU

Expert payroll insights for small business owners

insight

Switching Payroll Providers Made Easy

tool

Payroll Checklist for Small Business

guidebook

Hiring Guide for Small Businesses

VIEW MORE SMALL BUSINESS RESOURCES

Paying Your PeopleMaintaining Compliance

Recruiting & Hiring

Outsourcing HR

Ready to simplify your small business payroll?

Get pricing specific to your business.

Call 866-622-8153 or complete the form below:

Your privacy is assured.